- You are a private equity firm looking to potentially buyout an insurance company

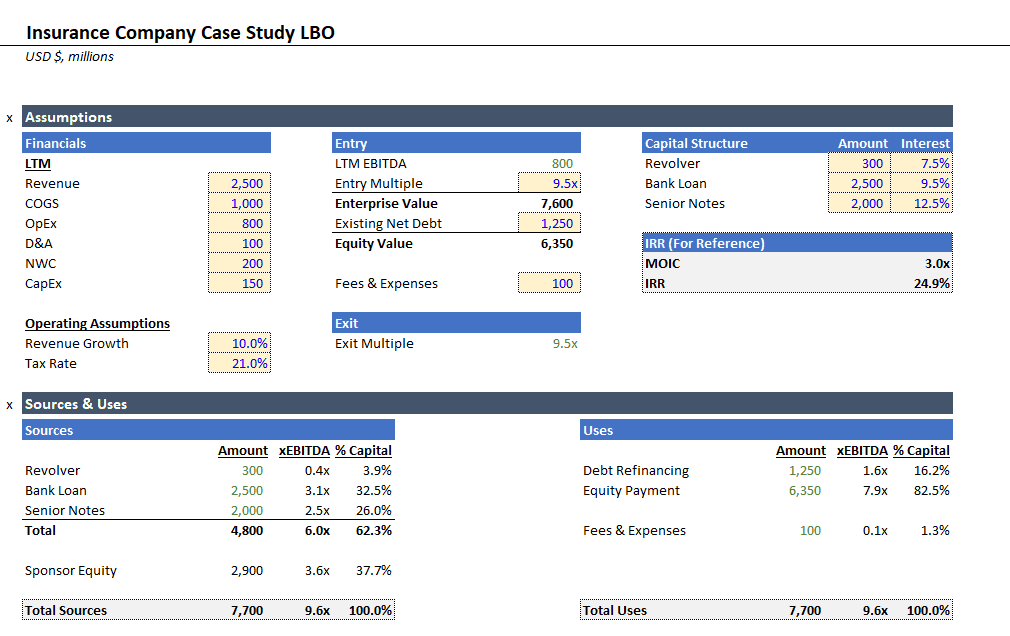

- LTM, the company has generated $2.5BN in sales, $1BN in COGS, $800M in OpEx, $100M in D&A, $200M in NWC, and $150M in CapEx

- For simplicity, your firm assumes they can grow the company revenue at 10% for the next 5 years, assumes a 21% tax rate, and assumes all margins will remain flat

- Your firm also believes it can enter and exit at a 9.5x EBITDA multiple at the end of year 5. The company has existing net debt of $1.25BN

- There will be 3 tranches of debt: $300M from a revolver (7.5% interest), $2.5BN from a bank loan (9.5% interest), and $2BN from senior notes (12.5% interest)

- Fees and expenses are estimated to amount to $100M