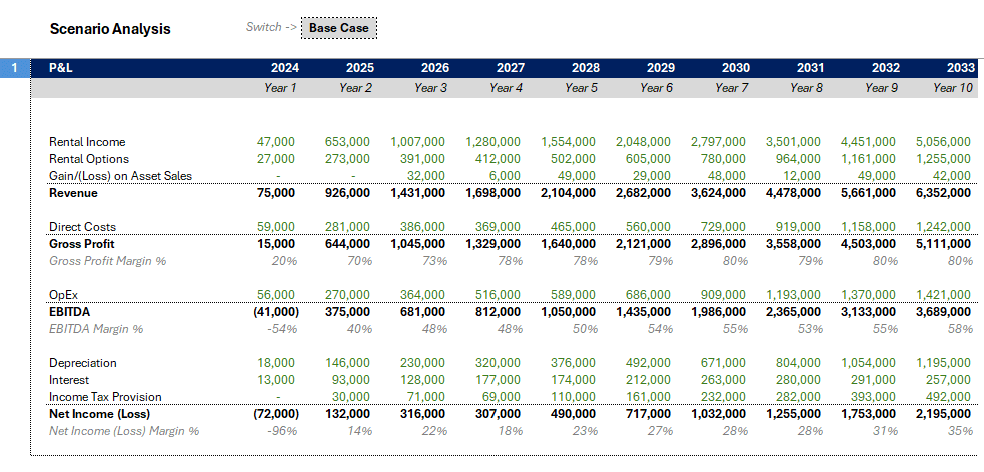

Paladin Exotics needed a financial model that addressed the unique challenges of an asset-driven business. Specifically, the company's financial projections were highly dependent on the size and composition of its vehicle fleet, which varied under different operating scenarios. The model needed to incorporate dynamic fleet management, accounting for acquisition costs, lease versus finance decisions, changes in rental demand, and changes in fixed costs. The goal was to create a tool that could provide insights into fleet performance under different configurations, ensuring Paladin could maintain healthy cash flows, manage capital expenditures effectively, and demonstrate long-term viability to attract both equity and debt financing.

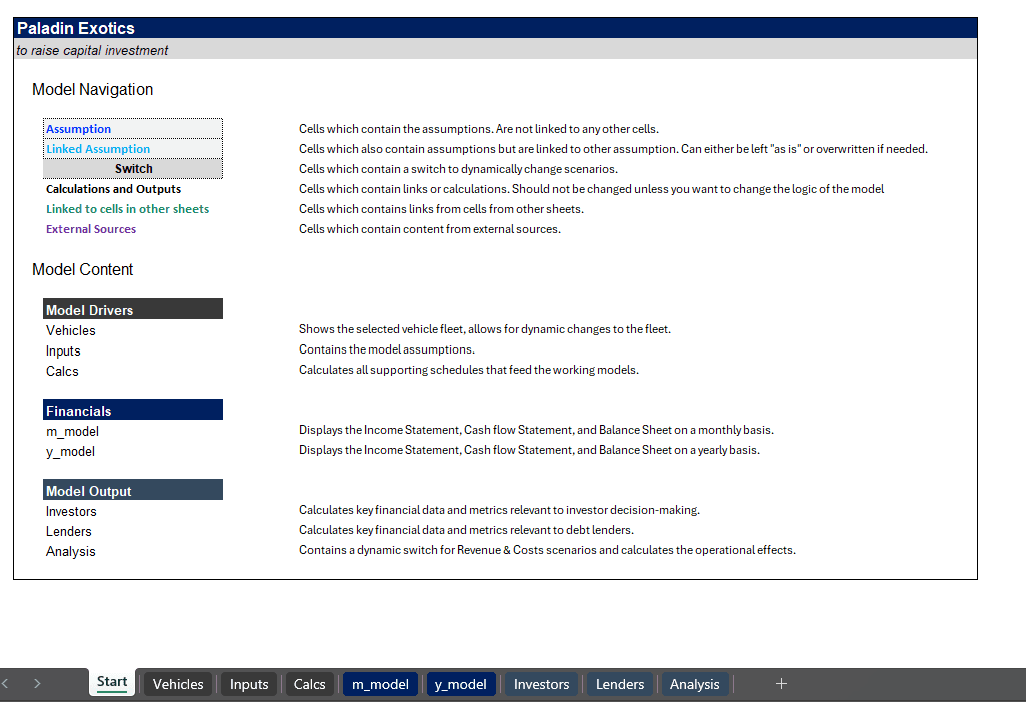

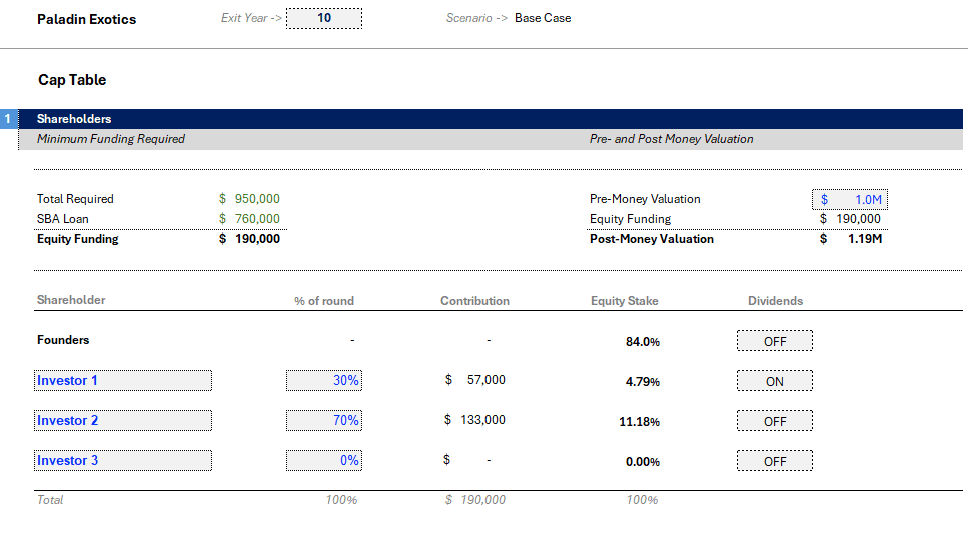

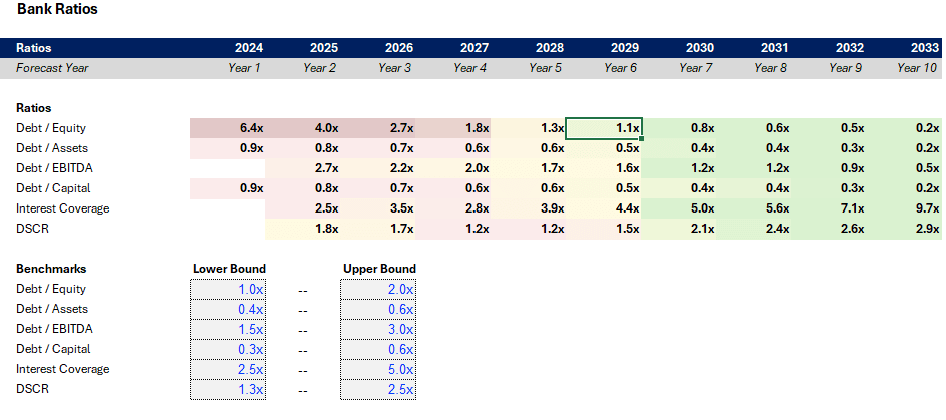

To address Paladin Exotics' financing needs, I developed a 10-year financial model that included multiple operational scenarios to facilitate investor and lender decision-making. The model incorporated detailed fleet management, asset schedules, revenue projections, cost analyses, and financial statements. Key highlights for stakeholders included an investor-focused Cap Table, dynamic Discounted Cash Flow analysis that projected returns based on potential exit scenarios, and a lender sheet providing detailed debt assumptions, repayment schedules, and ratio analyses to ensure compliance with SBA requirements. This ensured a comprehensive view of the business under different market conditions, satisfying the demands of both investors and lenders.